Frequently Asked Questions

What happens after I apply? And how can I make it go faster?

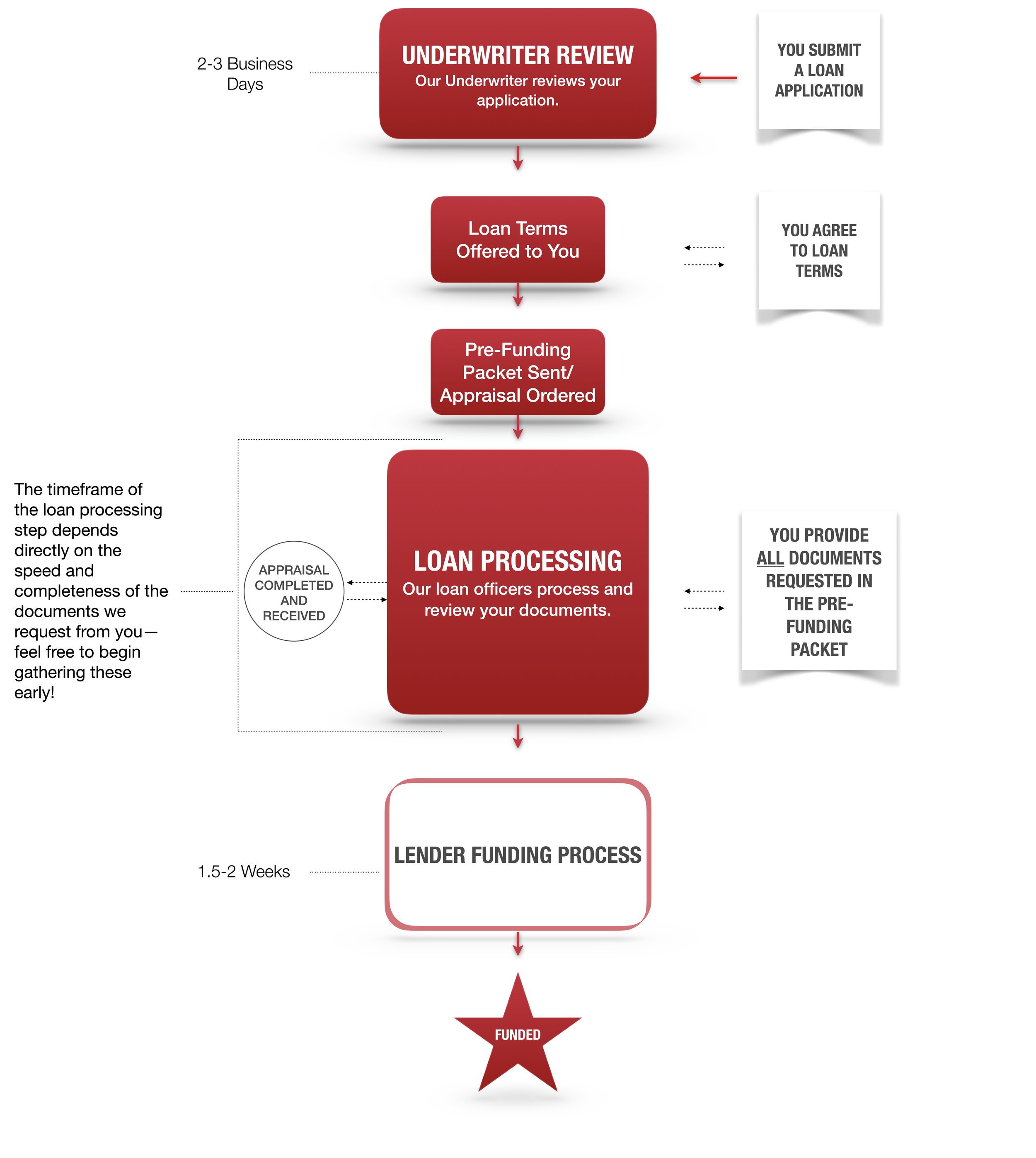

Clients often ask what they can do to speed up loan approval. To expedite, promptly provide all requested documents, especially those in the pre-funding packet. When we send it, you'll receive a specific document list. To get a head-start, click here to request a comprehensive list after submitting your application. See the graphic below for the process (click to enlarge).

What does the loan process look like?

Below is an outline of our loan process, with approximate timeline. The red boxes are actions we take, the white are your actions.

Glossary of Terms

-

The appraisal for a manufactured home today is very similar to any conventional home appraisal. The appraiser will use comparable sales within the last 6 months (not listings) within the community. These comparable sales will be adjusted against the buyers subject property to determine fair market value. This value is then used by the lender to determine the loan amount. Any buyer should always demand to know the exact appraised value on the property being purchased.

-

Purchasing a manufactured or mobile home for someone else. The home will not be occupied by the buyer.

-

Obtaining a new loan to pay off a current note holder (if applicable) plus cash out for debt consolidation, improvements, vacations, etc.

-

A manufactured or mobile home loan in a rental/lease park. This loan finances the home only. Rates and terms are normally different than a real estate loan.

-

There are 3 major credit reporting agencies: Experian, Equifax, and Transunion. Using a credit report, the lender will review current debt current past payment history, delinquent credit, etc.

-

Each credit reporting agency has a credit scoring system ( i.e. "FICO" score). The system is fairly complex but it primarily looks at your payment history and credit balances within the last 24 months. The score can range from 450 - 850. The higher the score the better. Normally, the higher the score the better the rate and term the buyer will receive.

-

An escrow company is a neutral 3rd party between buyer and seller. California state law requires an escrow company be used on any non-cash transaction. The escrow company will complete titling, tax clearance, fund distribution, etc.

-

Combining the financing of a piece of land and the manufactured home into one mortgage. This is a real property loan.

-

A loan financing only the manufactured home on a piece of private land. This is a chattel consumer loan.

-

Manufactured homes built after June 1976 are considered HUD homes - Homes built prior are considered pre-HUD homes.

-

The financing of a manufactured or mobile home located in a rental/lease park.

-

Obtaining a new loan to pay off a current note holder. No cash back to the borrower.

QUESTIONS? LET’S CHAT.

Please don’t hesitate to reach out. We’re in the office 8:30 AM to 5:00 PM during the week. Our staff will be happy to assist you however we can.